The $130 billion Job Keeper stimulus package may be a game changer for a lot of businesses owners, sole traders, and employees who have either been stood down already, or were fearing losing their job in the near future.

To reiterate, any business that has lost 30% or more of their revenue in recent weeks can apply for the Job Keeper package, which will subsidise $1,500 per employee per fortnight.

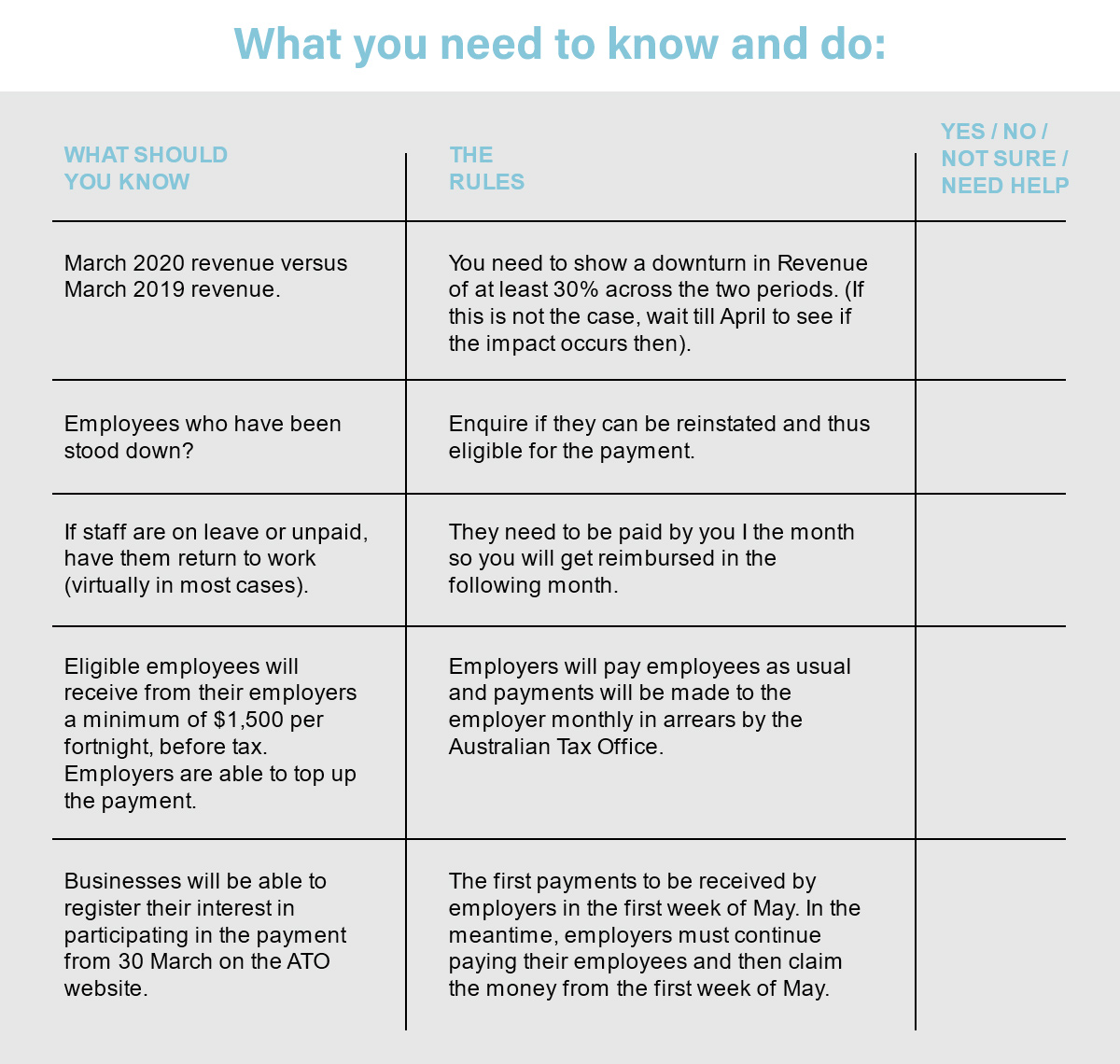

What you need to know and do:

If you are unsure about any of this, please contact us by email at inspire@propelbg.com.auor or call our offices on (08) 9440 7100.

We are here to help you through this period.

How can we help?

Fields marked with an * are required

"*" indicates required fields

Our Locations

Stirling

Suite 6, 36 Cedric Street

Stirling WA 6021 (08) 9440 7100

businessgrowth@propelbg.com.au

South Perth

Suite 50, 15 Labouchere Road

South Perth WA 6151 (08) 9474 3355

businessgrowth@propelbg.com.au

Karratha

Unit 4 / 16 Hedland Place

Karratha WA 6714 (08) 9144 1066

businessgrowth@propelbg.com.au